Initiate Coverage | Banking

November 28, 2016

Lakshmi Vilas Bank

BUY

CMP

`148

Initiating Coverage

Target Price

`174

Lakshmi Vilas Bank (LVB) is a south based private sector bank with major business

Investment Period

12 Months

(50.2%) concentrated in the state of Tamil Nadu. As of FY16, LVB has a network

of 460 branches and 910 ATMs, with business size of `45,250cr. LVB has beefed

Stock Info

up teams with lateral hiring from banks & NBFCs and implemented innovative

large scale technology for long term sustainability.

Sector

Banking

Focused & experience management to drive growth: At the end of CY2015, Axis

Market Cap (` cr)

2,650

Bank group executive, Mr. Parthasarathi Mukherjee, joined LVB as MD & CEO,

Beta

0.7

which was a sign of relief especially after the frequent exits in top management from

52 Week High / Low

169/78

2011-2015. Since then, LVB has successfully hired the top executives from other banks.

Avg. Daily Volume

79,946

Increasing mix of Retail/SME to drive credit: Over the next few years, the

Face Value (`)

10

management aim to scale up retail/SME portfolio from 43% (FY16) to 60%

(FY20); this should drive 18% loan CAGR over FY16-18. Within retail segment,

BSE Sensex

26,316

the bank intends to grow in mortgage and gradually get into two & four wheeler;

Nifty

8,114

while on SME, it will continue to focus on working capital financing. Considering

Reuters Code

LVLS.BO

the accelerated growth, management plans to raise capital (Tier-1) of ~`500cr.

Bloomberg Code

LVB@IN

Laying a sustainable foundation of CASA to boost NIM: LVB’s CASA ratio was at

14.9% (FY12) and has grown to 17.36% (FY16). Nevertheless, this is one of the

lowest CASA amongst regional banks. The new management targets to improve

CASA ratio by 2% every year for the next two-three years. LVB has taken a few

Shareholding Pattern (%)

steps: a) Offering higher interest rates (5-6%) vs. industry average (4%), b)

Promoters

9.7

Employing RM to garner salary A/C, c) On an average, addition of 70-80 branches

MF / Banks / Indian Fls

33.0

over the next three years, and d)Sales force incentivizes to mobilize liability products.

RoA booster - Focus fees income & non-funded business: LVB’s fees based

FII / NRIs / OCBs

8.7

income remained very low (0.5% of average assets over FY11-16), lower than

Indian Public / Others

48.7

close peer City Union bank (~0.75%). With extensive experience in corporate

banking, new MD has taken several steps to extend non-funded services to SME

such as treasury products, letter of credit, bank guarantees among others, etc. In

Abs. (%)

3m

1yr

3yr

addition to this, the third-party distribution will also contribute to the fees income.

Sensex

(5.5)

2.1

27.7

Asset quality: From the peak 3.4% (FY14), NPA declined to 1.3% (FY16) owing to

strengthening the credit underwriting and monitoring process. In 2QFY17, NPA

Lakshmi Vilas Bank

4.2

65.9

181.9

has increased to 1.87%.

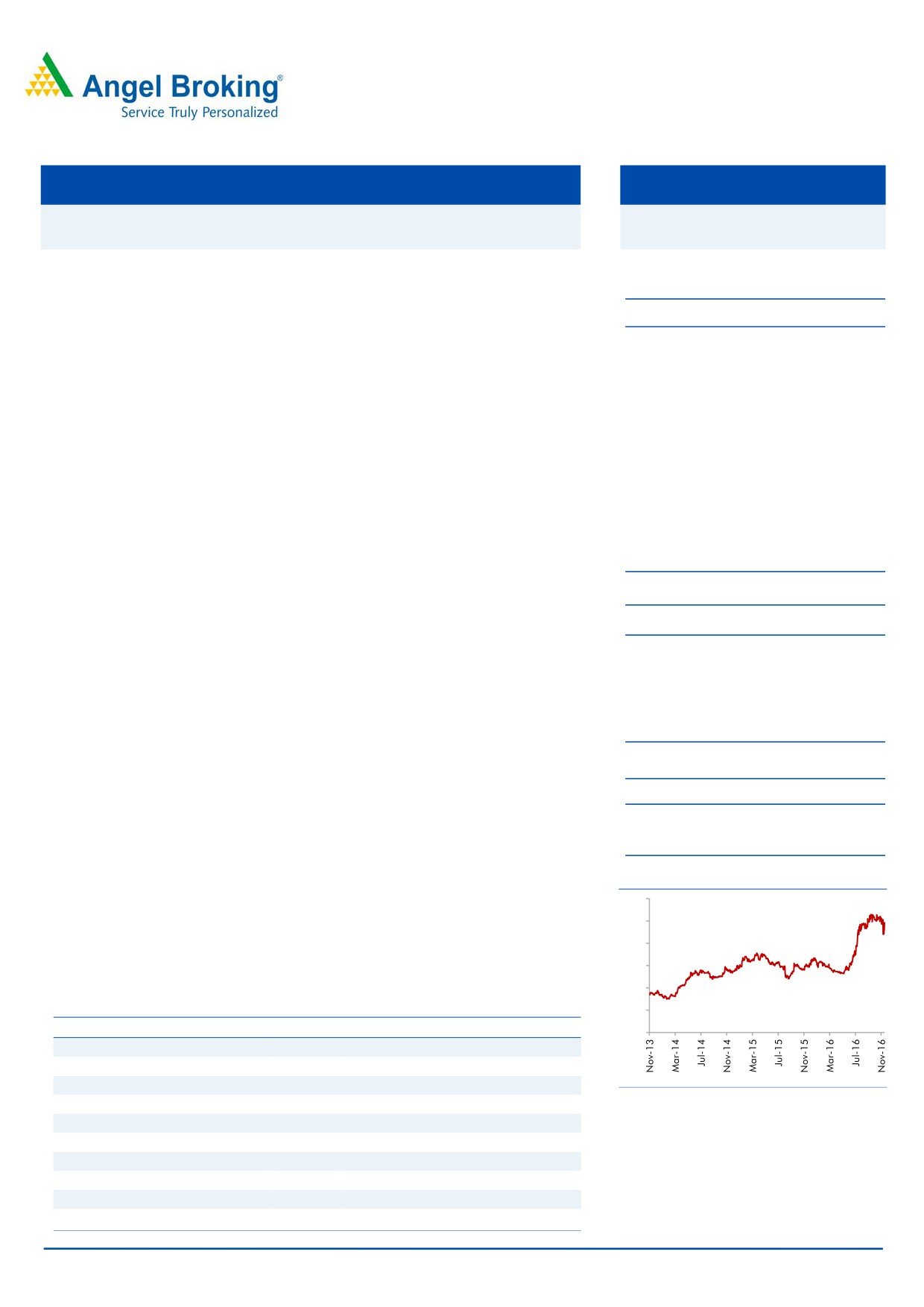

3-Year Daily Price Chart

Outlook & Valuation: We believe that scaling up of the liability franchise led by

180

CASA, higher contribution from other incomes and prudence approach to

150

alleviate bad loans will drive profitability and propel return ratio (FY18E -

ROE - 12.7% & RoA - 0.72). This can drive further re-rating. At the current market

120

price, the stock is trading at 1.25x its FY2018E BV of `116. We recommend a

90

BUY rating on the stock, with a target price of `174 (1.50x FY2018E BV).

60

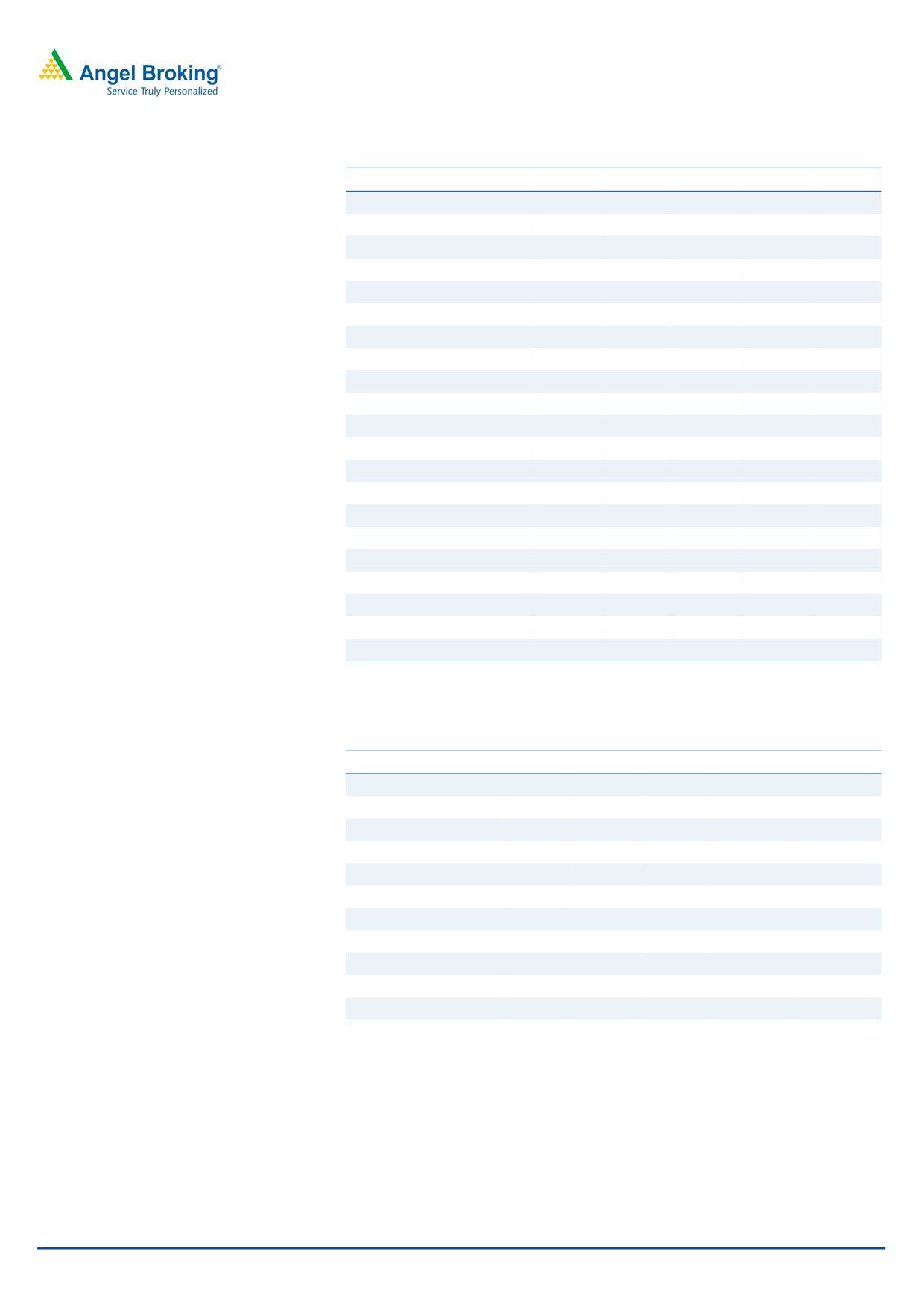

Key financials

30

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017E

FY2018E

0

NII

486

527

645

777

914

% chg

24.0

8.4

22.5

20.4

17.6

Net Profit

60

132

181

205

254

Source: Company, Angel Research

% chg

(34)

120

36

13

24

NIM%

2.8

2.6

2.6

2.7

2.8

EPS

6

7

10

11

14

P/E

24

20

14

13

10

P/ABV

1.8

1.9

1.6

1.6

1.4

Jaikishan Parmar

RoA (%)

0.31

0.58

0.68

0.66

0.72

+91 22 3935 7600 Ext: 6810

RoE (%)

5.8

10.1

10.9

11.2

12.7

Source: Company, Angel Research; Note: CMP as of November 28, 2016

Please refer to important disclosures at the end of this report

1

Lakshmi Vilas Bank | Initiating Coverage

Focused & experience management to drive growth

After the exits of MDs - Mr. PM Somasundaram (FY11-12), Mr. KSR Anjaneyulu

(FY13-14), and Mr. Rakesh Sharma (FY14-15), Mr. Parthasarathi Mukherjee, Axis

Bank group executive, joined LVB as MD & CEO at the end of CY2015. Since the

induction of new MD & CEO, LVB has been able to attract well-diversified talent

baked by rich financial services experience from lenders including HDFC, SBI, Axis

Bank, Royal Bank of Scotland and RBL to achieve transformational journey - LVB

2.0. We believe LVB is now equipped with experienced and strong credential team

to run next phase of growth.

Mr.Parthasarathi Mukherjee - MD and CEO

Mukherjee was earlier with Axis Bank as group executive (corporate relationships

and international business). He was with the bank for nearly 21 years. Before that,

he worked for the State Bank of India (SBI) for nearly 12 years. His expertise lies in

corporate relationships and international business.

Mr. NS Venkatesh - Executive Director

Former Executive Director and CFO of IDBI bank, with 33 years of experience.

RVS Sridhar - Chief risk Officer

His past experience was with SBI and AXIS bank. At Axis bank, he served for

21 years in Treasury, operation and Audit.

Mr. Govind Ravindran - Head Consumer Lending

Madhusudhana Rao - Chief Customer Service

Peeush Jain - Head of Business

B Nedumaran - Human Resources

The management has drafted Vision documents for 2020 and 2026, labelled LVB

2.0, with targets on asset size, market share and shareholder returns.

Exhibit 1: LVB 2.0

FY 16

FY 20E

Number of Branches

460

1000

Total Assets (INR Bn)

287

650

Net Interest Margins (%)

2.8%

3.3%

Cost/Income Ratio

57.1%

48.7%

Gross NPA

2.0%

1.6%

Return on Assets

0.7%

1.2%

Return on Equity

11.7%

18.3%

Source: Company, Angel Research

November 28, 2016

2

Lakshmi Vilas Bank | Initiating Coverage

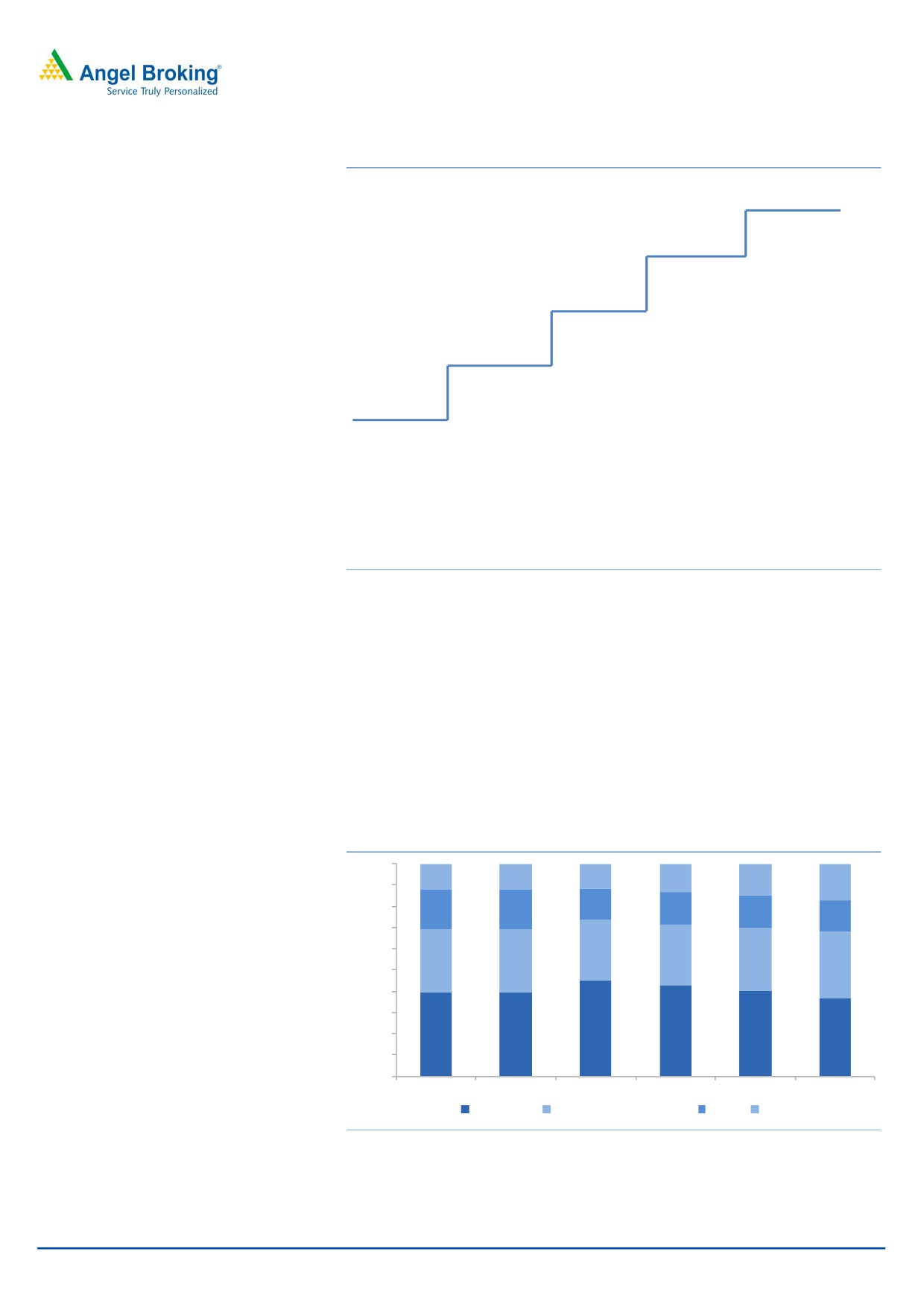

Exhibit 2: Strategic plan to accomplish LVB - 2.0

Sustainable

Growth

Target 10 years

CAGR of 20-25%.

CASA

Initial focus on

Focus on

deepening presence

increasing CASA

Credit

in focus geographies.

share through

branch specific

Building brand for

Strengthing

initiatives.

phased expansion in

Customer

credit and risk

contiguous markets

Segmentatio

functions.

Strong early

for wider presence.

progress.

n

Granular

Separation

customer for

of clients

focused

acquisition

Team

strategies

from credit

Focus to

appraisal.

augment skills

Retail:Initial

and capabilities.

focus on

mortgage and

Centralization

Strategic

vehicles; other

of wholesale

additions to fill

products in

credit

gaps.

phased manner.

Strengthing HR

MSME:

practices

Regional focus

Source: Company, Angel Research

Increasing mix of Retail/SME to drive credit: Over the next few years, the

management intends to ramp up retail/SME portfolio from 41.5% (FY16) to 60%

(FY20). This should drive 18% loan CAGR over the period of FY16-18. We believe

higher yielding retail portion would go up from current 13% (FY16) to 17.2%

(FY18), resulting retail book to grow at 30%+ CAGR over FY16-18. To attain this

high growth and gain retail proportion, bank has hired Mr. Govind Ravindran as

head of consumer and retail lending. Mr. Govind was working with HDFC for the

past 12 years and was handling Home/LAP business in Karnataka and Goa

region.

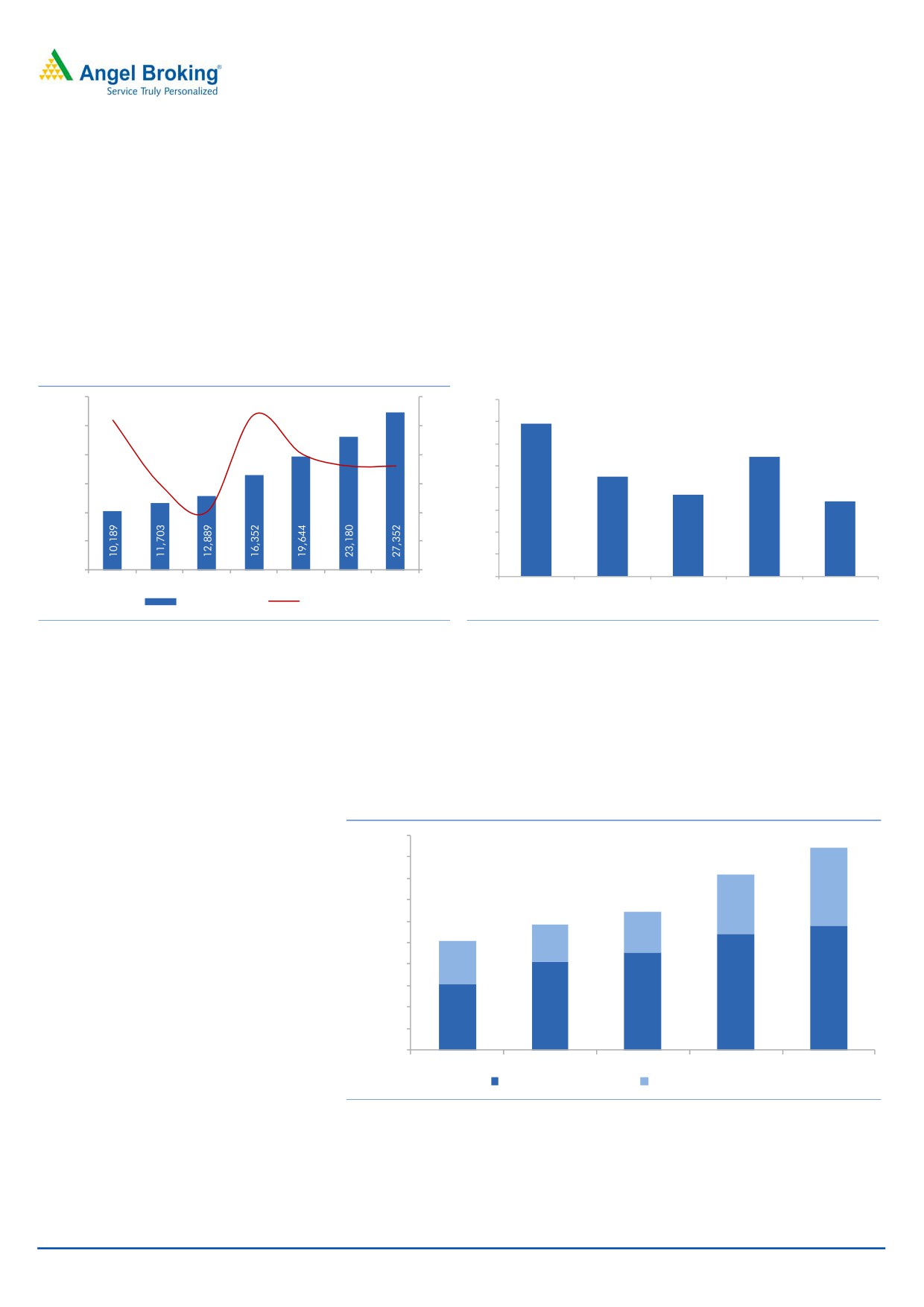

Exhibit 3: Loan Mix (%)

100

13

12

12

13

15

90

17

80

15

19

19

15

15

15

70

60

29

28

29

29

30

31

50

40

30

45

43

20

40

40

40

37

10

0

FY12

FY14

FY15

FY16

FY17E

FY18E

Wholesale

Mid-Commercial & SME

Rural

Retail

Source: Company, Angel Research

November 28, 2016

3

Lakshmi Vilas Bank | Initiating Coverage

The corporate loans (Wholesale) constitute around 43% (FY16) of the bank’s total

loan portfolio and continue to grow moderately by concentrating only top rated

corporate. The bank aims to increase retail/SME segment share as this offer better

yields as well as lower delinquencies. To accomplish target, bank is expanding

their services in calibrated manner beginning with Home loans, mortgages, and

then moving towards two-wheeler and four-wheeler financing. After an

appropriate level of experience, the bank is planning to get into unsecured

financing, including personal loans. To grow retail base at steady rate, bank is

putting together the collection and appraisal mechanism.

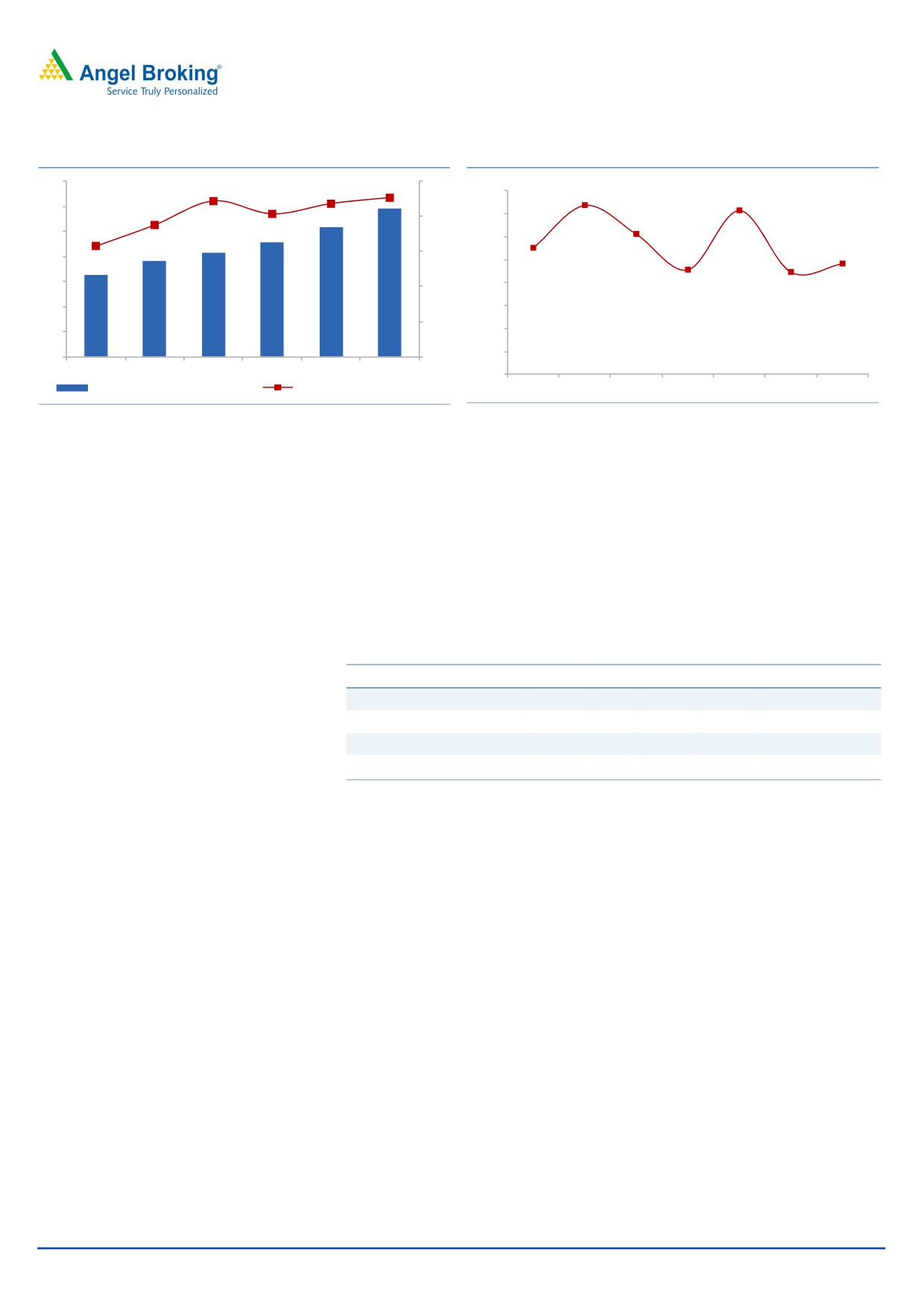

Exhibit 4: Loan Book Growth

Exhibit 5: Comparative - 4 Year CAGR Loan Book Growth

30,000

27

30

20

26

18

18

25,000

25

20

16

15

20,000

18

18

20

15

14

13

15,000

15

11

12

11

10

10,000

10

10

8

5,000

5

6

0

-

4

FY12

FY13

FY14

FY15

FY16

FY17E FY18E

Lakshmi Vilas

KVB

Federal Bank City Union bank South Indian

Advance (` Cr)

Growth (%)

Bank

bank

Source: Company, Angel Research

Source: Company, Angel Research

On SME front, it continues to focus on working capital. As working capital loans

are of shorter duration in nature and backed by cash flows from the business,

asset quality issues are relatively lower. Being a regional bank, it helps to

understand SME risk profile well. This can be leveraged to build SME lending

business with lower delinquency.

Exhibit 6: Working Capital Loan

20,000

18,000

16,000

7,207

14,000

5,580

12,000

3,851

10,000

3,479

8,000

3,993

6,000

11,622

10,772

4,000

8,223

9,038

6,196

2,000

-

FY12

FY13

FY14

FY15

FY16

Working Capital (` Cr) Term Loan (` Cr)

Source: Company, Angel Research

November 28, 2016

4

Lakshmi Vilas Bank | Initiating Coverage

Capital raising likely in 2HFY17

LVB’s tier-1 ratio stands at 8.2% as on Q2FY17. Taking into account the rate at

which the bank is growing and expected to grow, the management indicated that it

will raise ~`500cr of equity capital in 2HFY17. This should support the bank’s

target to grow at 18% for the next two years.

Laying a sustainable foundation of CASA to boost NIM: LVB’s CASA ratio was at

14.9% (FY12) and has grown to 17.36% (FY16). Nevertheless, this is one of the

lowest CASA ratio amongst regional banks. The new management has a slew of

steps to improve CASA ratio by 2% every year for the next two-three years. Steps

taken to improve CASA are: a)Offering competitive interest rate of 5-6 %, which is

higher than industry average on saving accounts, b)Launched new services such as

- Crown, NRI Banking Product, Flexi Current Account - SME, and Debit Card for

Entities, c)Formation of a new position - large business RM to tap salary account

and dedicated team for liability business d)On an average, addition of 70-80

branches over the next three years, and e)Freeing bandwidth at the branch level by

moving the credit appraisal function to the RO/CO level and sales force

incentivises to mobilise liability products.

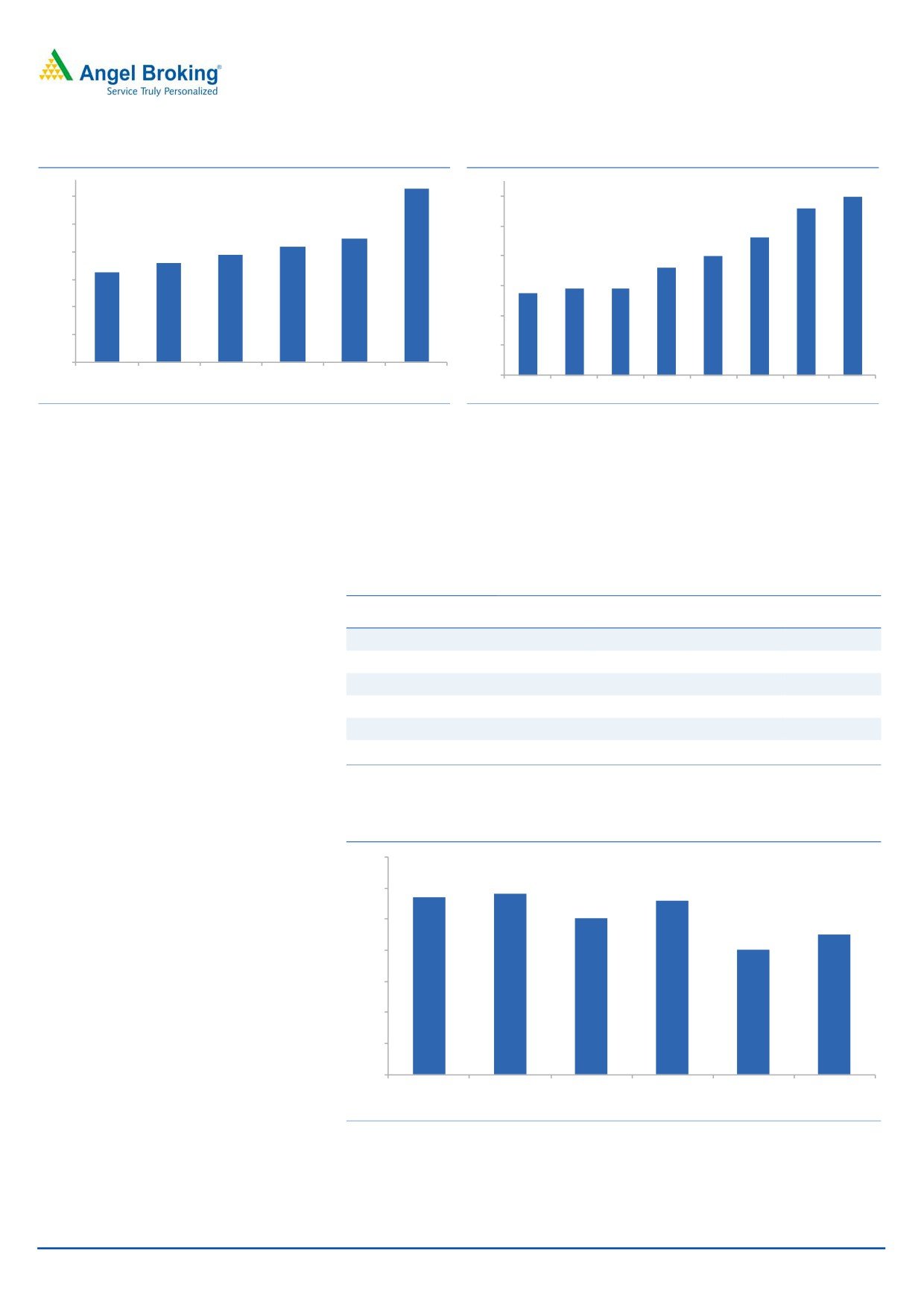

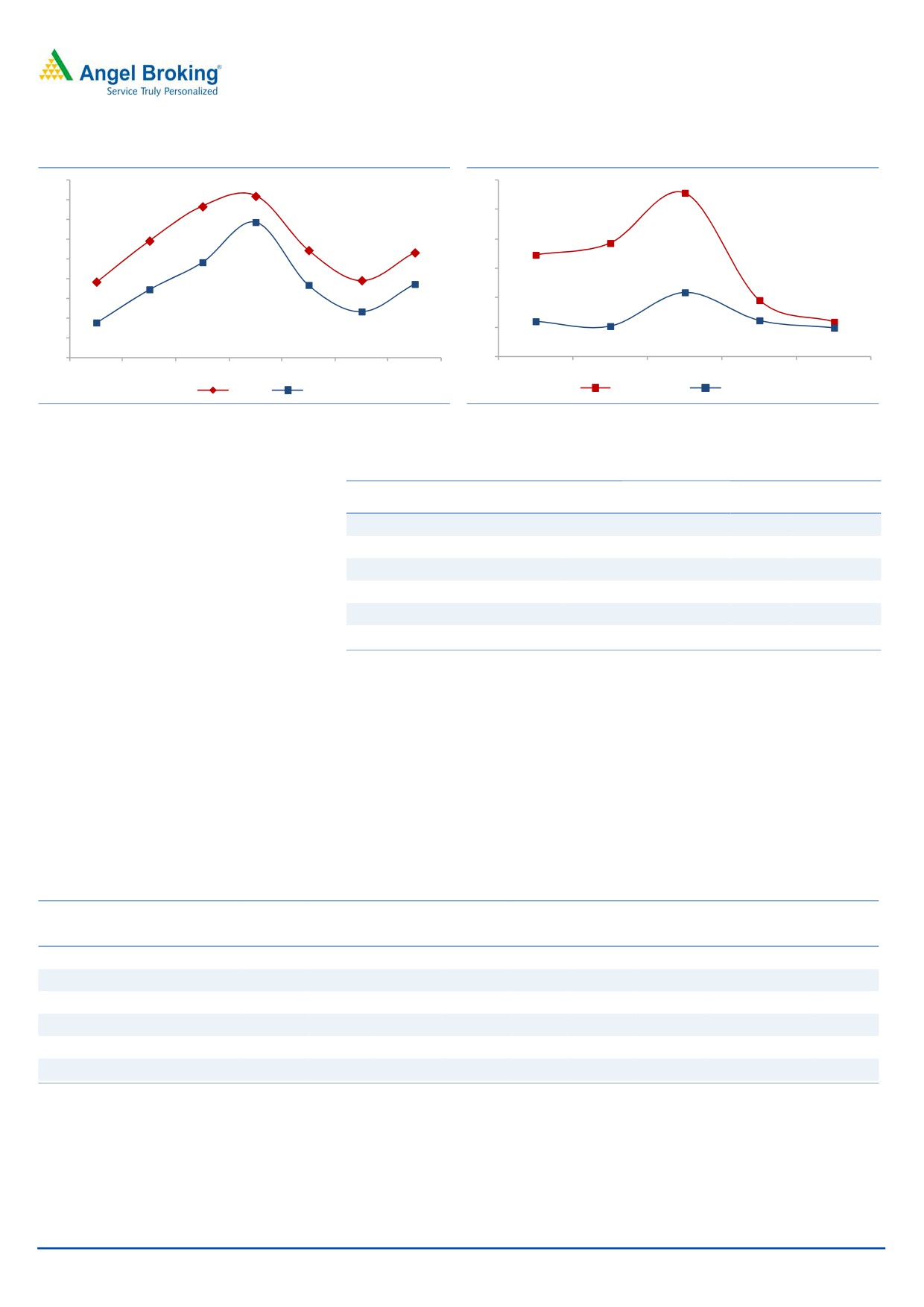

Exhibit 7: LVB - CASA (%)

20.0

18.9

18.1

17.4

18.0

16.7

16.0

14.9

14.5

14.5

14.0

12.0

10.0

8.0

6.0

4.0

2.0

0.0

FY12

FY13

FY14

FY15

FY16

FY17E

FY18E

Source: Company, Angel Research

Exhibit-8 clearly depicts LVB’s Casa (17.4%) ratio which is still lower compared to

regional peers such as Federal Bank Ltd (32.5%), KVB (23.3%), South Indian bank

(22%), and City Union bank (20.4%). Therefore, incumbent management has set

priorities to expand CASA by 2% every year for the next 2-3 years, led by branch

expansion, new customer acquisition, roll-out of new products and superior

technology. Improving share of low-cost CASA is likely to taper LVB’s overall cost

of deposits (which is again higher among peers) resulting stable/improving NIM.

November 28, 2016

5

Lakshmi Vilas Bank | Initiating Coverage

Exhibit 8: Comparative CASA (%) FY16

Exhibit 9: Branch Expansion

32.5

600

31.0

600

560

26.0

23.3

500

460

22.0

20.4

400

21.0

19.0

400

361

17.4

290

291

16.0

274

300

11.0

200

6.0

100

1.0

Lakshmi

RBL

City Union South Indian

KVB

Federal

0

Vilas Bank

bank

bank

Bank

FY11

FY12

FY13

FY14

FY15

FY16

FY17E FY18E

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit-10 shows there is enough scope to improve branch performance; LVB is

at lower end in almost all parameters. New team has been changing the hiring

culture to move towards a professionally run new-age bank. Additionally,

higher focus towards other income would also greatly benefit LVB to reduce

cost/income ratio.

Exhibit 10: Branch Efficiency Comparative (FY16)

Per Branch

Per branch

Per branch

Per Branch

(` Cr)

Business

CASA

Advance

Deposit

Lakshmi Vilas Bank

98

10

43

55

RBL

231

23

108

124

KVB

133

17

58

74

Federal Bank

110

21

46

63

City Union bank

92

11

40

52

South Indian bank

115

15

49

66

Source: Company, Angel Research

Exhibit 11: Comparative (FY16) - Cost/Income (%)

70.0

57.1

58.3

60.0

56.0

50.3

50.0

45.1

40.1

40.0

30.0

20.0

10.0

0.0

Lakshmi Vilas

RBL

KVB

Federal Bank City Union South Indian

Bank

bank

bank

Source: Company, Angel Research

November 28, 2016

6

Lakshmi Vilas Bank | Initiating Coverage

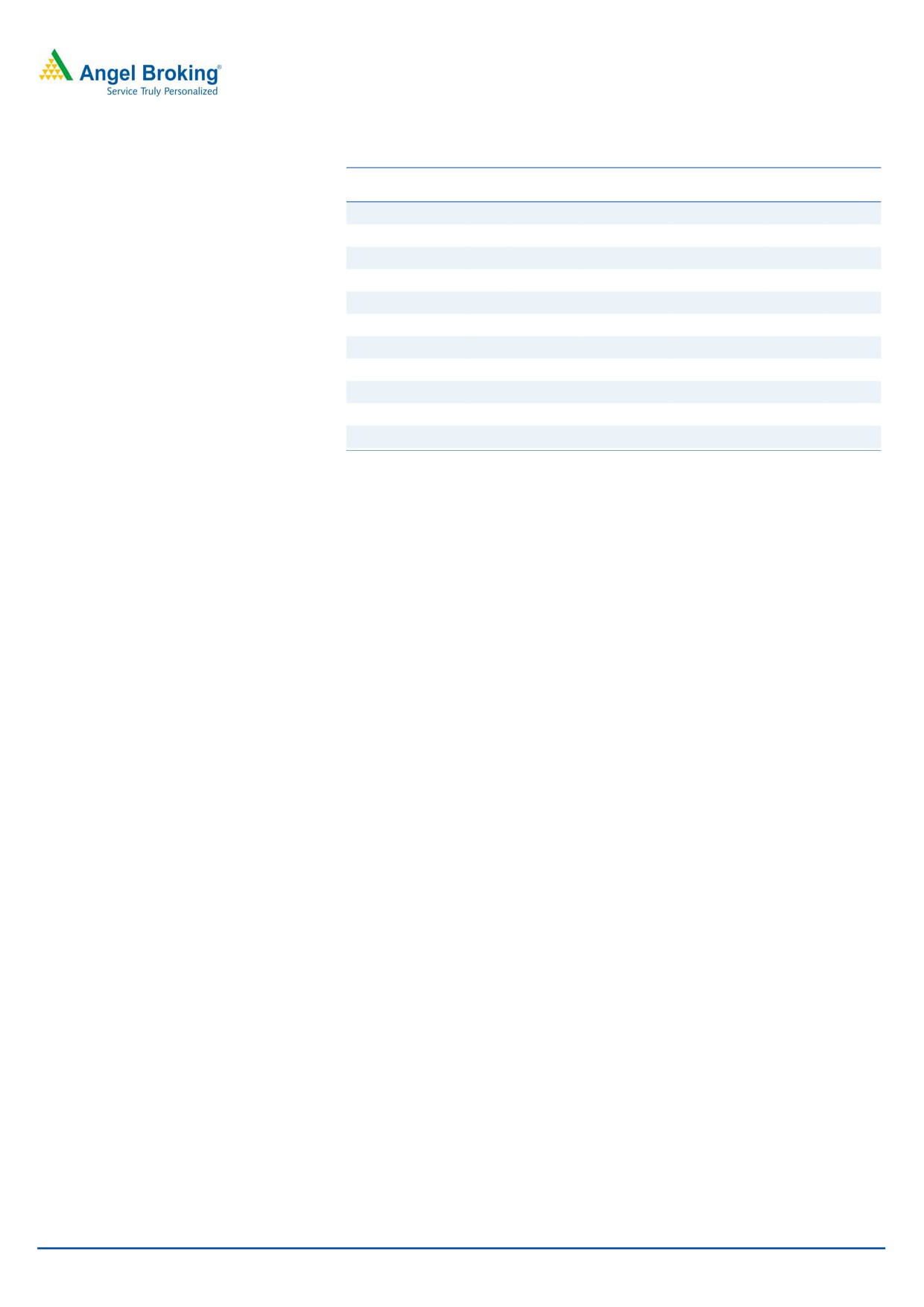

Exhibit 12: Business efficiency

Exhibit 13: Cost/Income (%)

14

89

91

100

87

58.0

57.4

81

57.1

12

75

80

57.0

56.1

12

10

63

55.5

56.0

10

60

54.8

8

9

54.6

54.5

55.0

8

8

6

54.0

7

40

4

53.0

20

2

52.0

51.0

0

0

FY11

FY12

FY13

FY14

FY15

FY16

50.0

Business Per Employee (` Cr)

Business Per Branch (` Cr)

FY12

FY13

FY14

FY15

FY16

FY17E

FY18E

Source: Company, Angel Research

Source: Company, Angel Research

ROA booster- Focus fees income & non funded business: Fees based income

remained very low over a period of time (0.5% of average assets over FY11-16),

which is lower than close peers - City Union bank (~0.75%). With wide experience

in corporate banking, the new MD has taken several steps to extend non-funded

services to SME such as treasury products, letter of credit, and bank guarantees

among others. In addition to this, third-party distribution fees will also contribute to

fees income. The new management’s target is to reach at 25% of total income in

FY26 from 11% in FY16.

Exhibit 14: Comparative of Non-fund based exposures, FY16

As % Of Total Asset

LVB

CUB KVB Federal

RBL Yes bank

Acceptances, Endorsement

4.4

1.1

4.1

1.4

3.3

15.6

Guarantees given

3.5

6.2

5.3

4.8

12.7

10.8

Forward Exchange Contracts

4.0

15.3

8.4

15.6

23.4

106.9

Total contingent liability

12.8

20.8

18.0

22.2

75.9

200.4

Source: Company, Angel Research

Better placed ALM, supported by retail deposit

LVB’s ALM is better placed as majority of its deposits (84.23%) and advances

(84.65%) are maturing up to 3 years. Similarly, maturity bucket in ALM helps bank

to maintain stable margin (NIM) as it is able to pass on deposit rate hike/decline to

borrowers.

Asset Quality

The bank has lent aggressively to corporate and registered high growth during

2009 to 2012. This led to spike in stress advance over FY13-14 as large part of

loans were lent to mid-corporate, which were badly hit by economic downturn.

GNPA peaked at 4.1% (FY14) from 1.9% (FY11). The bank has taken majority of

accounted stress assets, either NPA or sold to ARC. After 2014, GNPA/NPA has

constantly reduced. However, in Q2FY17, GNPA/ NPA increased moderately to

2.7%/1.9%, owing to one bill discounting fraud. We believe, going forward, the

asset quality to gradually improve considering alteration in lending decision.

November 28, 2016

7

Lakshmi Vilas Bank | Initiating Coverage

Exhibit 15: GNPA & NPA (%)

Exhibit 16: Slippages & Credit Cost (%)

4.5

4.1

6.0

5.6

3.8

4.0

5.0

3.5

3.0

3.4

3.9

2.7

2.7

3.0

4.0

3.5

2.5

2.4

2.0

1.9

3.0

2.0

1.8

1.9

1.9

1.7

1.5

2.0

2.2

1.2

1.2

1.0

0.9

1.0

0.5

1.2

1.2

1.0

1.0

0.0

0.0

FY11

FY12

FY13

FY14

FY15

FY16

1HFY17

FY12

FY13

FY14

FY15

FY16

GNPA

NPA

Slippages (%)

Credit Cost (%)

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 17: Comparative - Asset Quality

Total Stressed

FY16 (%)

NPA

PCR

Slippages

Asset

Lakshmi Vilas Bank

1.2

5.0

69

1.2

RBL

0.6

0.4

56

1.4

KVB

0.6

3.5

82

3.1

Federal Bank

1.7

2.6

72

3.7

City Union bank

1.5

1.4

60

2.4

South Indian bank

2.9

3.2

40

4.3

Source: Company, Angel Research

Outlook & Valuation

We believe that scaling up of the liability franchise led by CASA, higher

contribution from other incomes and prudence approach to alleviate bad loans

will drive profitability and propel return ratio (FY18E-ROE - 12.7% & RoA - 0.72).

This can drive further re-rating. At the current market price, the stock is trading at

1.25x its FY2018E BV of `116. We recommend a Buy rating on the stock, with a

target price of `174 (1.50x FY2018E BV).

Exhibit 18: Comparative table

P/BV*

ROE*

ROA*

4 CAGR

FY18E

FY16

FY17E

FY18E

FY16

FY17E

FY18E Loan growth (%) NPA (%)

Lakshmi Vilas Bank

1.2

10.9

11.2

12.7

0.68

0.66

0.72

18

1.2

RBL

2.6

11.2

12.3

13.9

0.83

0.96

1.04

51

0.6

KVB

0.9

12.9

12.1

14.2

1.02

0.93

1.04

13

0.6

Federal Bank

1.2

6.0

9.5

11.6

0.55

0.82

0.92

11

1.7

City Union bank

2.0

15.5

15.7

16.6

1.50

1.54

1.60

15

1.5

South Indian bank

0.6

9.0

10.7

12.2

0.55

0.63

0.70

11

2.9

Source: Company, Angel Research, Note: CMP as of November 23, 2016, * other bank Consensus taken from Bloomberg,

November 28, 2016

8

Lakshmi Vilas Bank | Initiating Coverage

Exhibit 19: Comparative DuPont Analysis

Federal

City Union

South Indian

FY2016

KVB

RBL

LVB

Bank

bank

bank

NII

3.2

2.9

3.3

2.5

2.5

2.4

Non Interest Income

1.3

0.9

1.4

0.8

1.5

1.1

Total Revenues

4.5

3.8

4.7

3.3

4.0

3.6

Operating Cost

2.3

2.1

1.9

1.9

2.3

2.0

PPP

0.6

0.8

0.8

0.6

0.3

0.7

Total provisions

0.6

0.8

0.8

0.6

0.3

0.7

Pre-Tax Profit

1.7

0.8

2.0

0.8

1.3

0.9

Tax

0.6

0.3

0.5

0.3

0.4

0.2

ROA

1.0

0.5

1.5

0.5

0.9

0.7

Leverage

12.6

11.0

10.3

16.4

12.7

16.1

RoE (%)

12.9

6.0

15.5

9.0

11.2

10.9

Source: Company, Angel Research

Key Risk

High concentration to a single state: LVB derives half of its business from 60%

branch network based in Tamil Nadu alone. Any change in socio political

situation/occurrence of a natural calamity can impact the economic condition of

the borrowers and in turn impact the credit quality of the company.

Standard Restructured: Higher delinquency from standard restructured can

escalate provisioning requirement and hence can impact the return ratio.

Demonetisation: For FY16, LVB loan book consist 26% of Mid Commercial & SME.

Post demonetization, higher slippages from SME loan Book may dent profitability.

Company background

Lakshmi Vilas Bank is a south based private sector bank with major business

(50.2%) concentrated in the state of Tamil Nadu. Currently, LVB has a network of

463 branches (plus 7 extension counters) pan India and 926 ATMs. The extensive

branch network (60%) in Tamil Nadu, which is one of the more progressive and

industrialized states in the country, provides a solid market base of business and

customers.

Key Management Personnel

The top management team comprises of Mr. Parthasarathi Muhkerjee, supported

by Mr. M. Palaniappan - Chief Financial officer, Mr. AJ Vidyasagar - CGM &

COO, and Mr. RM Meenakshi Sundaram - Chief General Manager of Whole Sale

Banking and General Managers.

November 28, 2016

9

Lakshmi Vilas Bank | Initiating Coverage

Income Statement

Y/E March (` cr)

FY14

FY15

FY16

FY17E

FY18E

NII

486

527

645

777

914

- YoY Growth (%)

24.0

8.4

22.5

20.4

17.6

Other Income

218

284

305

414

462

- YoY Growth (%)

10.6

30.3

7.2

35.9

11.6

Operating Income

704

811

950

1,191

1,376

- YoY Growth (%)

19.5

15.2

17.2

25.4

15.5

Operating Expenses

395

442

543

648

754

- YoY Growth (%)

16.9

12.0

22.7

19.5

16.3

Pre - Provision Profit

309

368

407

542

621

- YoY Growth (%)

23.0

19.2

10.5

33.2

14.6

Prov. & Cont.

269

180

177

269

269

- YoY Growth (%)

136.9

(32.9)

(2.0)

52.5

0.0

Profit Before Tax

40

188

231

273

352

- YoY Growth (%)

(70.7)

366.0

22.5

18.4

29.0

Prov. for Taxation

(20)

56

50

68

99

- YoY Growth (%)

-

-

(10.6)

36.5

44.5

PAT

60

132

181

205

254

- YoY Growth (%)

(34.4)

120.2

36.5

13.4

23.8

Balance Sheet

Y/E March (` cr)

FY14

FY15

FY16

FY17E

FY18E

Share Capital

98

179

179

179

179

Reserve & Surplus

956

1,377

1,584

1,727

1,905

Net Worth

1,054

1,556

1,764

1,907

2,084

Deposits

18,573

21,964

25,431

29,246

33,632

- YoY Growth (%)

18.9

18.3

15.8

15.0

15.0

Borrowing

458

458

723

847

975

Other Lia & Prov

568

727

815

930

1,100

Total Liabilities

20,653

24,705

28,732

32,930

37,792

Cash and Bal with RBI

1,192

1,143

1,287

1,367

1,493

Bal With BANK

120

175

82

137

157

Investment

5,689

6,051

6,545

7,108

7,860

Advance

12,889

16,352

19,644

23,180

27,352

- YoY Growth (%)

10.1

26.9

20.1

18.0

18.0

Fixed Asset

201

243

367

410

456

Other Asset

563

740

807

728

474

Total Asset

20,653

24,705

28,732

32,930

37,792

Growth (%)

16.9

19.6

16.3

14.6

14.8

November 28, 2016

10

Lakshmi Vilas Bank | Initiating Coverage

Ratio Analysis

Y/E March

FY14

FY15

FY16

FY17E

FY18E

Data Per Share

EPS

6.2

7.4

10.1

11.4

14.1

BV

108

87

98

106

116

Adj BV

80.5

76.8

88.4

91.3

101.1

Profitability ratio

NIM

2.8

2.6

2.6

2.7

2.8

Cost to Income

56.1

54.7

57.1

54.5

54.8

RoA

0.31

0.58

0.68

0.66

0.72

RoE

5.8

10.1

10.9

11.2

12.7

B/S ratios (%)

CASA Ratio

14.2

16.7

17.4

18.1

18.9

Credit/Deposit

71.9

72.1

75.9

78.3

80.4

Asset Quality

GNPA

4.1

2.7

2.0

2.0

1.7

NPA

3.4

1.8

1.2

1.1

0.9

Slippages

5.6

1.9

1.2

2.1

1.7

Credit Cost

2.2

1.2

1.0

1.3

1.1

Valuation

PER

23.5

19.6

14.4

12.7

10.3

P/ABVPS

1.8

1.9

1.6

1.6

1.4

Div Yield

0.7

1.4

2.1

2.4

2.9

Du Pont Analysis

FY14

FY15

FY16

FY17E

FY18E

NII

2.5

2.3

2.4

2.5

2.6

Non Interest Income

1.1

1.3

1.1

1.3

1.3

Total Revenues

3.7

3.6

3.6

3.9

3.9

Operating Cost

2.1

2.0

2.0

2.1

2.1

PPP

1.6

1.6

1.5

1.8

1.8

Total provisions

1.4

0.8

0.7

0.9

0.8

TreTax Profit

0.2

0.8

0.9

0.9

1.0

Tax

(0.1)

0.2

0.2

0.2

0.3

ROA

0.3

0.6

0.7

0.7

0.7

Leverage

18.5

17.4

16.1

16.8

17.7

RoE (%)

5.8

10.1

10.9

11.2

12.7

Source: Company, Angel Research

November 28, 2016

11

Lakshmi Vilas Bank | Initiating Coverage

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

Lakshmi Vilas Bank

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

November 28, 2016

12